For experienced CFOs and treasurers, identifying the ideal banking partner to meet their trade financing requirements can be a challenging endeavour. Given the constraints of time and the constantly shifting market landscape, organizations seek a banking partner that exhibits a blend of deep understanding in their operations and a shared vision. CFOs and treasurers can forge a strong partnership that supports their financial goals and helps navigate the complexities of the trade financing landscape.

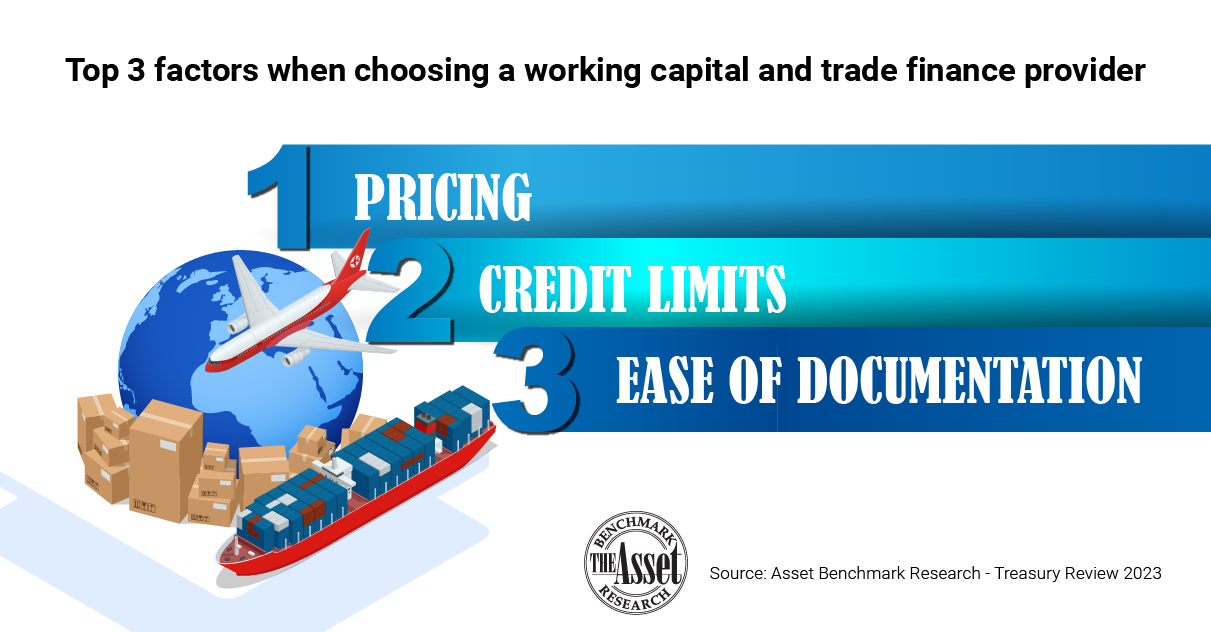

Based on the observation of Asset Benchmark Research’s Treasury Review 2023, when choosing a working capital and trade finance provider, three key factors to consider remain consistent with the previous year: pricing, credit limits, and ease of documentation.

However, there has been a shift in emphasis, with less focus on credit limits in 2022 and a greater emphasis on innovative financing structures. The focus on innovative financing structures highlights a growing recognition among businesses of the need to adapt to evolving market dynamics and seek out innovative solutions to meet their working capital and trade finance requirements.

Moreover, the review also revealed that the majority of respondents work with two to three banks to fulfil their trade finance needs, with a notable increase in the number of respondents working with over five banks compared with the previous year. This shift indicates a broader diversification of trade finance partnerships, suggesting that businesses are actively seeking out additional banking relationships to optimize their trade finance operations. By expanding their network of banking partners, companies can access a wider range of financial products and services, enhancing their trade finance capabilities and fostering greater flexibility in managing their working capital.

Trade finance professionals place high priority on several factors when evaluating what constitutes a great transaction bank. Notably, three key factors emerge as pivotal:

There has been an increased emphasis on response time to queries compared with the previous year’s findings. It indicates that trade finance professionals highly value the speed of implementation offered by transaction banks. This suggests a growing need for efficient and timely execution of trade finance transactions to meet the demands of fast-paced business environments. Organizations appreciate transaction banks that can swiftly process and execute trade finance requests, enabling them to seize opportunities and optimize their operations.

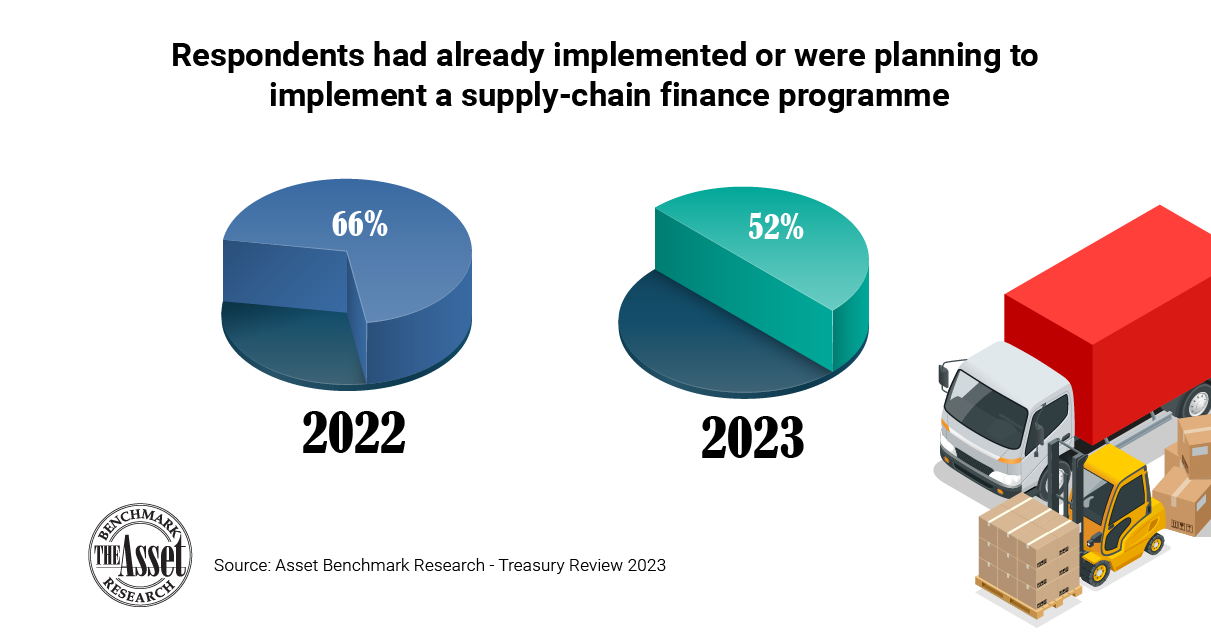

In 2023, the presence of supply-chain finance programmes among respondents showed a decline compared with the previous year, with only 52% of the respondents having implemented or planning to implement a supply-chain finance programme, compared with 66% in 2022.

The decrease in adoption indicates a shift in priorities or challenges faced by organizations in implementing such initiatives, potentially influenced by factors like changes in market conditions, evolving business strategies or difficulties in securing necessary resources.

The lower adoption rate of supply-chain finance programmes could be temporary, reflecting a delay in implementation plans rather than a complete abandonment of such initiatives, as organizations take additional time to evaluate options and refine strategies before moving forward.

Of those with supply-chain finance programmes established, a majority of respondents ( 59% ) had supplier finance programmes as opposed to account receivables purchase programmes.

In today’s high-interest rate environment, companies are cautious about borrowing, leading them to hold onto inventory and accounts receivables to minimize the carry costs of working capital. Despite these challenges, supplier financing emerges as a valuable solution that addresses obstacles faced by both large corporations and small enterprises with limited credit profiles. By implementing a supplier finance programme, banking partners can provide crucial support to suppliers while leveraging the creditworthiness of large corporations for quick funding.

In addition, respondents of the Treasury Review 2023 cited the top three benefits of deploying supply-chain finance programmes as:

In line with The Asset’s commitment to promoting best practices in the Asian financial industry, ABR conducted an extensive study involving over 500 CFOs, treasurers, and treasury management professionals in the Asia-Pacific region. The engagement with respondents took place during the first half of 2023 through a combination of one-on-one interviews and an online survey.

For more information about the Treasury Review 2023, please go here.